Table of Content

Since September 2003, Titles and Certificates of Attachment for manufactured homes in Texas have been replaced by the Statement of Ownership and Location . A Statement of Ownership must replace any certificate of title. The electronic statements are kept in online records to keep track of every mobile home in the State of Texas. To replace a Certificate of Attachment for a real property SOL, you need to send an SOL application and the original COA or an affidavit of fact which states that the COA was filed in the real property records. If there are no changes and you send the original COA or affidavit to the TDHCA, there are no required fees. A warranty deed will be necessary to transfer title if your state is one of the few that recognizes mobile homes as real property.

Most counties want to see that the mobile home is included in the legal description on a deed where the land and home have been sold together as a package. Also, the mobile home must be titled and RP’d into the person’s name who owns the land before it can be retired. If your state requires a title application, it will need to be filled out and signed by the buyer and, in some cases, both parties . The first step to writing a bill of sale is to first come to a terms agreement between the buyer and seller, which includes the price of the mobile home. The home will need to pass an inspection conducted by a certified inspector, and the report will most likely be finished within 48 hours.

We are here to help take the headache out of dealing with Mobile Homes by handling

If the buyers refuse to transfer the ownership into their names you may want to mention that as the mobile home owner you will resell it to another buyer that is willing to transfer the property into their name. You will need a Bill of Sale and a statement from the Tax Assessor-Collector at the local tax collector’s office to prove all taxes have been paid on the home. Within 60 days of closing a sale, sellers are required to submit an Application for SOL along with the required fee. If they submit the application after 60 days, there will be a late fee charged up to $100.

Though it may seem intimidating, buying a mobile home in Texas can be extremely easy once you have a solid idea of what you’re looking for and how to do it. To receive a lost title replacement, the mobile home owner first needs to complete the Application for Statement of Ownership and Location form. The state mobile program provides a way for Texas businesses and people who are homebound to schedule free mobile vaccinations.

Where to Start the Transfer Process

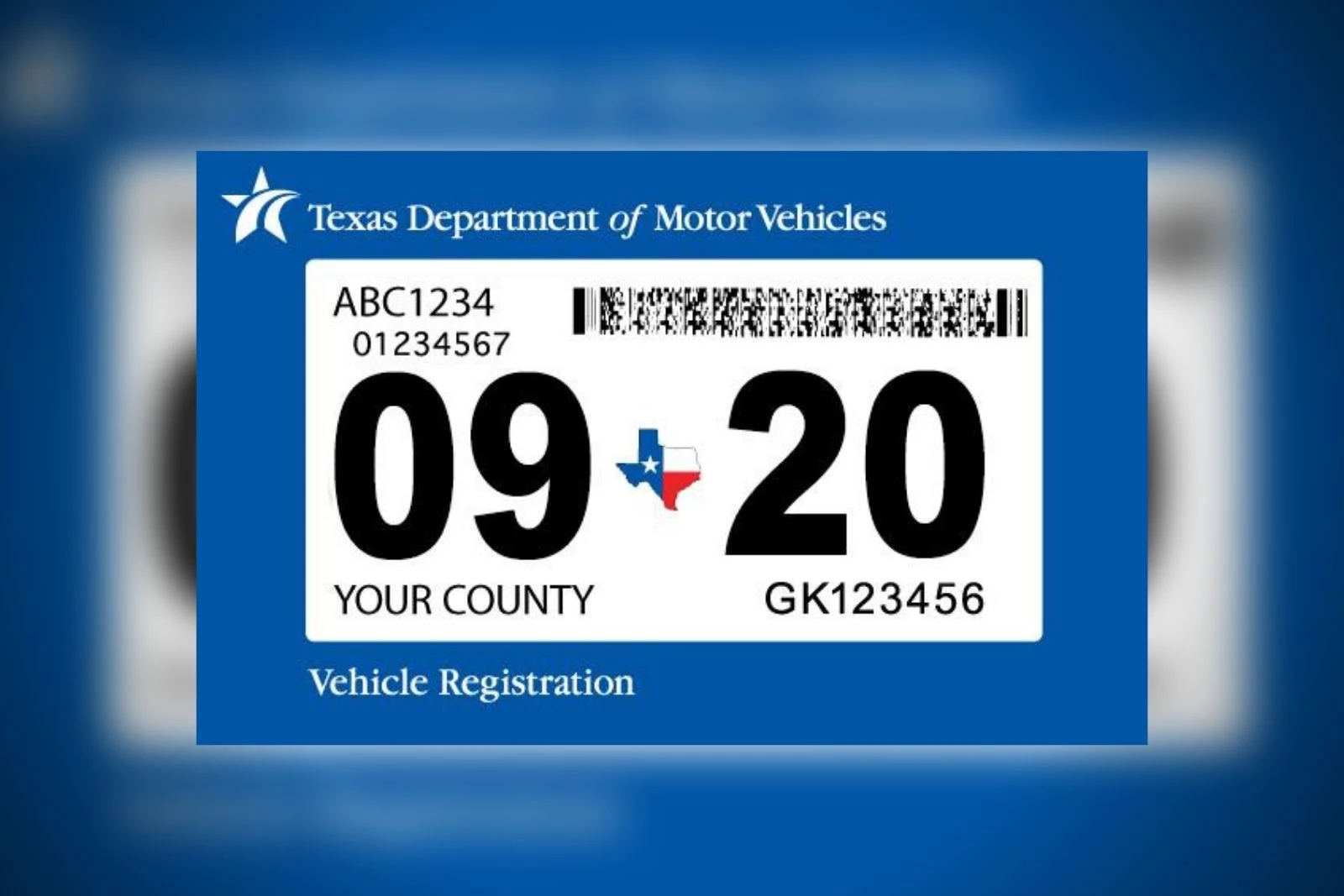

In cases where the mobile home is being transferred along with the land it sits on, the process becomes more complicated. If the home does not possess the required Texas Seal or HUD Label, there is an extra fee of $35 per Texas Seal per section of the home. The fee for a single is $35, doublewide is $70, and triple wide is $105. There is no additional fee for the release of lien when it is part of a transfer of ownership. However, if you do buy a mobile home without a title, the seller will need to complete the Application for SOL form and pay the $55 issuance fee after the sale within 60 days. To replace the title with a personal property Statement of Ownership and Location, you will need to submit an SOL application and the original title document.

However, in the State of Texas, the certificate of title was replaced by the Statement of Ownership and Location . In the State of Texas, all mobile or manufactured home Statement of Ownership are issued by the Texas Department of Housing and Community Affairs , Manufactured Housing Division located in Austin. Mobile, Modular, and Manufactured Home Title Company is a full-service provider of Mobile Home Titling & Appraisal Services in this State. Used Mobile Home Sales, Title Transactions, Mobile Home Park Owners, Oil & Gas Companies, and Local and State Authorities. If your state requires a title application, the buyer and, in some situations, both parties must fill it out and sign it.

Mobile Home Titles in Texas

If the manufactured home is affixed to a solid foundation, it is no longer considered personal property in many states. So, before you buy or sell a mobile home, it's a good idea to look out for the titling requirements in your state. A mobile home title, like a house or automobile title, can reveal whether the present owner has any liens on the property; this means they still pay taxes or fines. In most situations, if liens encumbered the property, the owner will not possess the title.

This paperwork will prove that the buyer and seller have agreed to sell the mobile home. It will often include the serial number or VIN of the mobile home, buyer and seller information, purchase price, purchase date, and buyer and seller signatures. This document may be required to be notarized in some states. Depending on the state, the office in charge of title transfer for mobile homes will differ. You may be obliged to attend the Department of Housing if your state recognizes mobile homes as real estate. A Statement of Ownership application costs $55 to process, and a late application may result in a $100 fee and a delay in its issuance if it is over 60 days late.

REAL ESTATE LAW

If there's something about the exchange you need more information on, withhold your signature until you can make necessary changes to the agreement. Proof that the mobile home's property taxes have been paid may be required. This verification is usually available from the local taxing authority.

They also need the approval of each lien holder and must place the lien holders' written consent on file with the TDHCA. They are exempt from this requirement if a title company handles the transaction and insures the property against existing liens. The TDHCA requires a copy of the title commitment or policy. Finally, the homeowner must submit the Application for Statement of Ownership with all supporting documentation and fees.

This document will serve as proof that the buyer and seller have agreed on the sale of the mobile home. It will generally include the mobile home’s serial number or VIN, buyer and seller information, purchase price, purchase date, and signatures of buyers and sellers. The office responsible for title transfer of mobile homes will vary depending on the state.

The TDHCA requires an inspection and lien search to prove there are no liens on the property. Homeowners must also notify their county tax assessor of this change in order to alter how the home's property taxes will be assessed. Make sure to stay in communication with the buyers to verify that they have mailed all forms to the state in order to change ownership. Verify this ownership change has made online using the green button above. This can cause property taxes to accrue in your name while you technically still own the mobile home.

So if you don't have the certificate of title for the manufactured house you own or wish to buy, you're missing out on important information. The mobile home changes its treatment, as from real to personal property and vice versa. After June 2003, the TDHCA replaced the Certificate of Title with a Statement of Ownership and Location , which eventually became known as a Statement of Ownership.

They'll need to provide evidence of ownership, such as a bill of sale, contract, deed, purchase agreement or sale receipts. The TDHCA reviews the application upon receipt and if it finds the evidence presented to be insufficient, it will notify the applicant and send a Request for Additional Information . Once the agency deems the application complete, it issues the Statement of Ownership. If a buyer purchases their manufactured home from a licensed retailer, that seller assists them in completing the necessary forms. The retailer must also provide the required information, supporting documents and fees to the TDHCA. Before June 2003, manufactured homes in the state of Texas carried a Certificate of Title.

There's no evidence that the vaccines cause long-term health problems. We provide you with complete, accurate, and current mobile home information so you can get it right. Texas has seen a steady increase in mobile, or manufactured, home numbers throughout the state.

You will need to include a receipt from the Tax Assessor-Collector with your form, which shows that no taxes remain unpaid on the home, and a lien release form from the previous lien holder. If there is/are no HUD Label or Texas Seal on your home, a Texas Seal will need to be purchased and will be issued to each section of the mobile home at an additional cost of $35.00 per section of home. This “No label or no seal” will be notated on the SOL Application section 2 described below.

No comments:

Post a Comment